1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

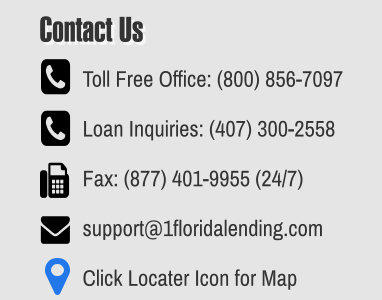

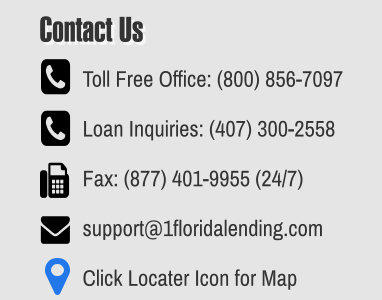

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

VA home LOANS

TURNED DOWN BY YOUR LENDER? CALL US!

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County

The VA Loan is a home-mortgage

option available to United States

Veterans, Service Members and not

remarried spouses. VA Loans are

issued by qualified lenders and

guaranteed by the U.S. Department

of Veterans Affairs

U.S. Military Veterans and their families may

qualify for a VA Home Loan guaranteed by

the United States Department of Veterans

Affairs.

VA home loans originated in 1944 as part of

the original Servicemen’s Readjustment Act,

also known as the GI Bill of Rights. The GI

Bill was signed into law by President Franklin

D. Roosevelt and provided veterans with a

federally guaranteed home with no down

payment. This feature was designed to offer

housing and assistance to veterans and their

families, making the dream of home

ownership a reality for millions of veterans.

VA loans are another option for borrowers

with little free cash but decent credit, provided

they’ve served in the military. You’ll need to

obtain a Certificate of Eligibility through your

lender or the VA Loan Eligibility Center before

you will be able to close your loan, however.

Qualifying for a VA loan is a lot different than

any other loan on the market – the

Department of Veterans Affairs places no

strict limits on the credit eligibility or debt to

income ratios of the borrowers they insure.

Instead, most underwriting items are left to

the discretion of the bank involved.

The Department of Veterans Affairs may not

provide a lot of guidelines on who to loan VA

funds to, but they’re very strict on what fees

can be paid by borrowers and how much they

can pay for things like closing costs. Items

not reimbursed under “itemized fees and

charges” on the HUD-1 form are limited to

one percent of the loan amount in most

cases, and those “itemized fees and charges”

are tightly regulated.

Even though VA loans are an excellent option

for many veterans, there are a few

drawbacks. If you have plenty of cash and

excellent credit, you may be able to find a

better rate with a conventional loan, plus

you’ll avoid the VA funding fee. In addition,

some sellers may be nervous about

accepting a real estate contract with VA

financing attached, especially if they or their

agent believe your loan may take extra time

to close.

What is the New VA Advantage?

Our New VA Loan as many advantages that

make it one of the most appealing paths to

home ownership and this great benefit is

reserved exclusively to those who bravely

served our country and select military

spouses. When combined, the benefits of the

VA mortgage allow service members and

Veterans to take advantage of substantial

cost savings under qualification requirements

designed specifically for members of the

military and their unique needs

What are the VA Primary Home

Purchase Highlights?

•

Min FICO 580, 100% LTV

•

VA Cash Out Refinance

•

Min FICO 580, 90% LTV

•

Min FICO 600, 100% LTV

•

Min FICO 640, 100% LTV

VA IRRRL

•

Min FICO 550, 100% LTV

•

Min FICO 580, 125% LTV

•

Min FICO 640, 125% LTV

Important updates

•

Prior ITIN number to a newly issued SSN

- OK

•

No Credit using non-traditional tradelines

Absence of Credit History For borrower(s)

with no established credit history, base the

determination on the borrower’s payment

record on alternative or nontraditional credit

directly from the borrower or creditor in which

a payment history can be verified. Absence of

a credit history is not generally considered an

adverse factor. It may result when:

•

Borrower has not yet developed a credit

history; o Borrower has routinely used

cash rather than credit; and/or

•

Borrower has not used since some

disruptive credit event, such as

bankruptcy or debt pro-ration through

consumer credit counseling

•

Guidelines for Borrowers having not

established credit

•

12 to 24 month housing payment history,

no late payments; borrowers without

housing payment history will not be

considered for manual underwriting

•

A minimum of three non-traditional credit

sources

•

Maximum payment shock of 100%

•

Limited credit history cannot be used to

overcome poor credit history; RMCR must

be ordered to confirm limited/no credit

What are the VA Home Loan

Benefits?

•

There are many benefits to pursuing a VA

home loan as opposed to a traditional

mortgage. Primarily, VA home loans:

•

Do not require a down payment

•

Have lower interest rates than traditional

financing

•

Are backed by the Department of

Veterans Affairs

•

Do not need private mortgage insurance

•

Have more flexible loan requirements

•

Only require limited closing costs

•

Have no penalty fee if you pay off your

home loan early

•

Allow you to sell your home or refinance

without restrictions

•

Can be used to purchase a home, condo,

duplex, and other types of properties

•

Allow for the funding fee to be financed

with the loan (or sometimes waived

completely)

•

Are assumable, meaning they can be

transferred to a VA-eligible buyer

•

Can have a non-spouse family member

added for VA joint loans

•

Cashout up to 90% of the home’s value

(100% in some cases)

Since VA home loans do not require monthly

mortgage insurance (MI) and offer more

favorable terms, they are usually more

affordable. As such, borrowers are better able

to focus on paying off debt and other financial

obligations.

MILITARY STATUS

Dont have a DD-214? If you are a military

veteran. Fill out their request form and they

will send a blank "Request Pertaining to

Military Records" Form SF 180.

For your future, all veterans who have been

discharged, separated or retired should keep

multiple copies of your DD-214 discharge

paperwork. It's the most important military

document in your records, for many reasons.

The DD-214 is proof of your military status,

whether you are retired, separated,

discharged. It also displays the nature of your

discharge, and your status with the National

Guard or a Reserve Unit.

Having your DD-214 form can speed your VA

processes to a quick and satisfying

conclusion.

If you are a recently discharged military

member who separated or retired at an

overseas location, remember that your DD-

214 form may be delayed overseas for up to

a year before it becomes part of the National

Record Center archives. If this is the case,

you contact the orderly room, First Sergeant

or Sergeant Major in charge of where you

separated or retired and request a copy

directly from your final base DD-214 Request.