1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

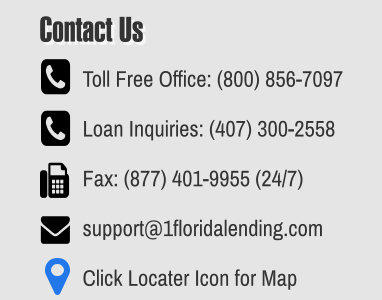

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

COMMERCIAL REAL ESTATE LOANS

Commercial Property Loans

A commercial property loan is a type of

mortgage specifically designed for

purchasing, refinancing, or developing

commercial real estate. This can include

office buildings, retail spaces, warehouses,

industrial properties, multi-family residential

buildings (5+ units), Single Family, Multifamily

5+ Units, Mixed-Use Property, Office

Buildings, Office Condos, Retail Stores, Strip

Malls, Adult Care centers, Shopping Centers

Warehouses, Self-Storage, Auto Service,

Industrial property, Manufacturing property,

Medical Offices and much more…we just

added 1 to 4 unit Residential Assisted Living

Facilities

These loans are typically used by businesses

or investors who plan to use the property for

commercial purposes, generate income, or as

an investment.

Choosing the Right Commercial Property

The type of property you choose can

significantly impact your loan terms and

overall investment success. Properties in

prime locations tend to appreciate more and

attract higher rental incomes. Older

properties may require more maintenance,

impacting your cash flow. Perhaps more

importantly is market trends in that different

property types have varying risk profiles. For

example, retail spaces might have higher

risks than office buildings, affecting the

interest rate and loan-to-value ratio you can

secure.

We Can Help You Avoid A Just

Missed Special Use Property

Opportunity by utilizing our Full, Lite,

and No-Documentation Commerical

Loan

A few examples include:

•

Income property - Not fully stabilized

•

Special use property types

•

Longer, fixed rate amortization periods

•

High leverage/Loan-to-Value (LTV) ratios

•

Property in need of renovations,

improvements or repairs

•

Under-leased property

At 1st Florida Lending Corp, we have been

closing Commercial Real Estate and

Investment Property loans in Florida since

2007 offering fast funding by seasoned

professionals. So, whether your need an in-

the-box or outside-the-box or even if we need

to invent-a-box of its own… We have a loan

program for you and pride ourselves on our

fast-specialized service, our ability to

structure for a smooth closing and finding

just the right program for your income

property needs or special situation

Loan Options

Purchase Loans

•

Purpose: Finance the acquisition of a new

commercial property.

•

Loan-to-Value (LTV) Ratio: Up to 75%

(subject to qualification).

•

Interest Rates: Competitive fixed and

variable rates available.

•

Terms: 30 years, and Interest only Arms

with amortization schedules up to 30

years.

•

Income Options: No Income, P & L

Statements, Business Income

•

Credit Requirements: For most programs

Credit scores not required

•

Tradelines: Some trade-lines may be

required

•

Property Appraisal: Only AMC certified

appraisal companies allowed; A second

appraisal may be required for property

exceeding 2 million

Refinance Loans

•

Purpose: Refinance and Cash-out an

existing commercial property loan to

reduce interest rates, lower monthly

payments, or access equity.

•

Loan-to-Value (LTV) Ratio: 65% to 75%

(depending on property type and market

conditions).

•

Interest Rates: We provide competitive

rates, with options for both fixed and

adjustable rates.

•

Terms: Flexible terms ranging from 5 to

30 years. Ask your loan officer for more

details

•

Requirements: Current loan details,

updated property appraisal, financial

documentation.

Ground Up Construction Loans

•

Purpose: Finance the construction of new

commercial properties

•

Interest Rates: Typically, higher than

purchase loans, with options for fixed or

floating rates.

•

Terms: Usually 12 to 36 months, with

potential for conversion to permanent

financing.

•

Requirements: Detailed construction

plans, contractor agreements, project

timeline, business financials etc..Ask your

loan officer for more details

Benefits of Commercial Property Loans

•

Custom Financing Solutions: Tailored

loan structures to fit your business’s

unique needs, including different payment

schedules and terms.

•

Equity Access: Refinance to tap into the

equity of your existing property for

business expansion or other investments.

•

Tax Benefits: Interest payments on

commercial loans are often tax-

deductible, reducing the overall cost of

borrowing.

•

Asset Ownership: Owning commercial

property allows your business to benefit

from appreciation, rather than just paying

rent.

Eligibility Criteria

•

This loan relies solely on the appraised

value of the property and not the borrower

who only has to provide the sources of

funds for the down payment, closing

costs and some reserves if required.

Generally, having a credit score is not

required, However, some programs

require a minimum 620 middle score.

FAQs about Commercial Property

Loans

Q. How do interest rates on commercial

property loans compare to residential

mortgages?

A. Interest rates for commercial loans are

generally higher than residential mortgages

due to increased risk.

Q. Can I get a commercial property loan with

bad credit?

A. While having good credit may be beneficial

for some programs. Most programs do not

require a credit score

Q. What is the typical down payment required

for a commercial property loan?

A. The typical down payment ranges for

purchases from 20-30% of the property’s

purchase price, depending on underwriting,

loan type, credit and financial stability.

Q. How long does it take to get approved for

a commercial property loan?

A. The approval process typically takes as

little as 15 days and as much as 30 days,

depending on the complexity and unforeseen

issue of property and securing the source by

the borrower for the down payment, closing

cost and reserves

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County