1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

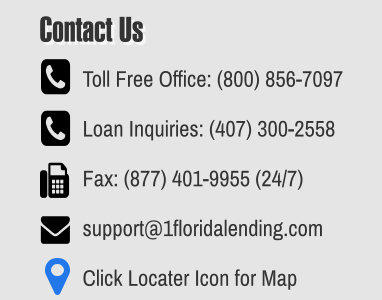

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

REAL ESTATE INVESTMENT LOANS

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County

Unlock Your Real Estate

Investment Potential with our New

INVEST15 Loan - No Income or

Employment Verification Required-

Min. Loan Amount of $150,000

Are you ready to take your real estate

investments to the next level? With our

INVEST15 Loan Program, you can seize

new opportunities without the hassle of

traditional income or employment

verification.

At 1st Florida Lending, we specialize in

investment financing, making it simpler

and more accessible to secure funding for

property purchases, rate/term refinancing,

and cash-out refinancing.

Whether you're a seasoned investor or just

starting out, the program INVEST15 is

designed to provide you with fast, flexible

financing to grow your portfolio.

Investment property loans offered by most

lenders often require a higher down

payment, typically between 20% to 30%.

However, with our innovative INVEST15

loan program, you can start with as little as

a 15% down payment, regardless of your

income or employment status.

More importantly, our INVEST15 Program

is designed with flexibility in mind,

overcoming common barriers such as

property types, credit events, and

citizenship status, all while being

customized to meet your budget and

investment goals.

Key Highlights of the INVEST15

Investment Property Loan

Program:

Income Requirements

Unlike traditional home loans, which require

stable income verification, our INVEST15

investment property loans eliminate the

need for income or employment

documentation. You can qualify without

proving income, making the process

smoother and faster.

Down Payment & Terms

15% down with a 30 to 40 Year Amortized

& Term option. A larger down payment can

reduce your interest rate and monthly

payments. In some cases, a higher down

payment may be necessary based on

factors such as credit score and tradeline

history.

Credit Score

A minimum credit score of 620 is typically

required, but a score of 660 or higher can

secure better terms and lower interest

rates.

Cash Reserves

Prepare to have cash reserves equivalent

to 3 to 6 months of mortgage payments.

This ensures you have a financial cushion,

adding security to your investment.

Rental Income

We streamline the qualification process by

considering existing rental income or, if

none, relying on the appraiser's estimated

rental income for the area, as outlined in

the 1007 form. This makes it easier to

qualify for both short-term and long-term

rental properties.

Property Types

•

Our loans cover a variety of property

types, including:

•

Single-family homes

•

Multi-family units (5+ dwellings)

•

Condos (Warrantable and Non-

Warrantable)

•

Townhouses

•

Condotels

•

Planned Unit Developments (PUD)

Credit Events

Don’t let past credit issues hold you back.

Our INVEST15 program is open to those

who have experienced foreclosure,

bankruptcy, short sale, or deed-in-lieu of

foreclosure. Contact your loan officer for

specific details.

Citizenship Requirements

INVEST15 loans are available to both U.S.

citizens and non-U.S. citizens, with specific

conditions that may apply depending on

your country of origin.

Identification Requirements

We accept various forms of identification,

including:

•

Current Driver’s License

•

Valid Passport

•

ITIN Card

•

Current Visa

•

Other valid forms of ID

Entity Closing Options

With INVEST15, you have the flexibility to

close in your personal name or through

various entities, including:

•

LLC (Limited Liability Company): Ideal

for investments due to liability

protection and tax benefits.

•

Corporation: Provides liability

protection, though tax implications can

be more complex.

•

Partnership: Common for joint

investments, with partners sharing

liability unless structured as a Limited

Partnership.

Advantages of Getting an Investment

Property Loan with 1st Florida Lending

At 1st Florida Lending, we’re here to

support your real estate investment journey

along with the benefits and flexibility of our

INVEST15 program.

Owning an investment property lets your

money work for you. It provides extra

income, diversifies your portfolio, increases

your net worth, and provides extra

insurance against shocks in the market.

Whether you are financing a single asset

for buy and hold or looking to refinance a

portfolio of real estate assets, 1st Florida

Lending has experience Loan Officers

working with real estate investors

throughout the state of Florida.

It is an easy way to expand your real estate

holdings because it allows us to determine

your ability make payments without

needing your income.

Investment Vacation Rental Property

•

Beach or ski rentals can yield the

equivalent of a month’s long-term rent

in a week.

•

Vacation rental services can

supplement and even a few nights a

month can add up to the mortgage

being covered

•

You can use when you wish

College Investment Property

•

Almost always a demand

•

High rents because college-owned

competition charges top dollar

•

Rental market is calculated with each

individual tenant’s share compared

against dorm or college-owned

apartment rates (as opposed to one

rate for entire property)

•

The area markets itself

•

You can have property do double duty if

you buy where your children plan to

attend school

•

Rent short term during summer or off

season for orientation, summer school,

sports competitions, etc.

Long-term Investment Property

•

Steady tenants, sometimes for years,

allow you to know and trust who is

caring for your home and build equity

•

Low turnover can help you anticipate

repairs (tenants have proven they won’t

damage property, but regular upkeep

will still be necessary)

•

It can be a “passive investment.” If

management company is utilized, it can

handle all leasing, tenant interactions

and repairs.

•

Track market and sell when it’s most

advantageous

Click Here to request a quote or contact us

today at 800-655-1635 or direct at 407-300-

2558 to learn more about how our

INVEST15 loan can help you achieve your

investment property financing goals.