Who We Are

At 1st Florida Lending, we are direct mortgage

lenders—not retail brokers—dedicated to

providing exceptional, affordable, and

customized lending experiences. Our innovative

technology, industry-leading systems, and

extensive portfolio featuring over 48 diverse

loan programs ensure every borrower receives

financing tailored precisely to their unique

financial circumstances.

Our Expert Team

We proudly employ a team of highly trained,

multilingual, and fully licensed mortgage

professionals. Unlike lenders who rely on

unlicensed coordinators reading scripted

responses, our experienced loan officers

provide personalized solutions, leveraging

years of expertise to ensure a smooth and

efficient loan process from application to

closing.

Our Mission & Vision

At 1st Florida Lending, our core belief is simple:

borrowers are people, not just numbers. Our

mission is to deliver personalized mortgage

solutions that align with your individual

financial goals, ensuring your mortgage

experience is both rewarding and stress-free.

Why We Stand Out

Expertise in Complex Loans: We

specialize in complex loan scenarios

and consistently secure approvals,

even in challenging financial situations.

Industry Leadership: We proactively

stay ahead of industry trends and

regulatory changes, providing

borrowers with innovative and timely

lending solutions.

Experienced Leadership: Our founders’

extensive experience through various

financial markets strengthens our

commitment to reliable, customer-

centric mortgage services.

Flexible Financing: We offer versatile

mortgage solutions at competitive

rates for both U.S. residents and

foreign nationals—options often

unavailable through traditional banking

channels.

Supporting First-Time Home Buyers

Purchasing your first home can feel

overwhelming, involving significant financial

decisions, strict regulations, and detailed credit

requirements. Our knowledgeable loan officers

are committed to guiding you through every

step, ensuring clarity, confidence, and informed

decision-making throughout the process.

Why Choose 1st Florida Lending?

Choosing a mortgage lender involves more

than competitive interest rates—it requires

integrity, transparency, and personalized

support. Here’s why borrowers consistently

choose us:

Customized Mortgage Solutions: We

recognize that every borrower’s financial

situation is unique, providing

personalized guidance tailored

specifically to your needs.

Comprehensive Loan Programs: Our

extensive range includes home purchase

loans, refinancing, debt restructuring, and

reverse mortgages, ensuring solutions for

all financial situations.

Dedicated Expert Professionals: Our

licensed loan officers offer exceptional

service and personalized attention,

creating a seamless lending experience

from start to finish.

Our Commitment to Community &

Philanthropy

Social responsibility is integral to our business

philosophy at 1st Florida Lending. We measure

our success by the positive impact we make

within our community. Our team actively

supports numerous charitable organizations

through financial contributions, volunteering,

and community outreach programs,

empowering our employees to create

meaningful change.

In Summary

The mortgage industry is continuously evolving,

and at 1st Florida Lending, we’re here to ensure

your borrowing journey is smooth, efficient, and

rewarding. Our dedicated team is committed to

helping you secure the best mortgage program

at competitive rates, ensuring you feel

supported and informed every step of the way.

Ready to Get Started?

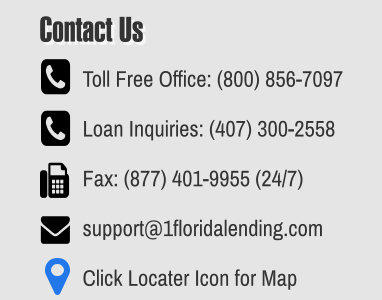

Our multilingual staff is ready to help! Call us

today at 407-300-2558 to discuss your

personalized home financing options.

1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

TURNED DOWN BY YOUR LENDER? CALL US!

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County