We are proud of the many charities we support! Just to name a few ...

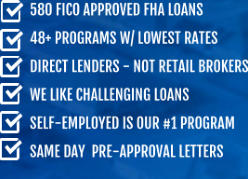

12 AND 24 MONTHS BANK STATEMENT LOANS

For Self-Employed, DBA’s, Sole Proprietors, Corporations, 1099 Independent Contractors and W-2 Wage Earners

Why a Bank Statement Loan?

With over 14 programs our Bank Statement Loan programs are rapidly becoming the loan of choice For Self-Employed,

DBA’s, Sole Proprietors, Corporations, 1099 Independent Contractors and W-2 wage earners who have cash flow and

payment history, but show a reduced taxable income as a result of high deductions

“We offer programs with 1 day out of a recent mortgage events like Bankruptcy, Foreclosure and Short Sale”

Changing tax status from W-2 to 1099 self-employed? There generally is a 12 month waiting period after you change

your tax status from wage earner (W-2) to independent Contractor (1099) or New Business owner. However, there are

exceptions in lowering the waiting period which is considered on a case by case basis or we offer a No Income

verification and no employment verification Stated Income Mortgage

© 2007 - 2023 1st Florida Lending Corp. - All rights reserved I Privacy Policy I Terms of Use I

- MORTGAGE GLOSSARY OF TERMS

- MORTGAGE CALCULATOR

- LOAN PROGRAMS

- USDA LOAN INFORMATION

- NON-QM MORTGAGE

- PRE-APPROVAL DOCUMENT-CHECKLIST

- APPRAISALS

- LEARN ABOUT CREDIT

- REPAIR YOUR CREDIT

- CLOSING COST

- REFINANCING YOUR LOAN

- MORTGAGE CREDIT EVENTS

- PMI-MORTGAGE INSURANCE

- FORECLOSURE INFORMATION

- CONDO PURCHASE WARNINGS

- THE LOAN PRE-APPROVAL PROCESS

- FHA LOANS - NO DOWN PAYMENT

- BANK STATEMENT LOANS - 90% LTV

- JUMBO LOANS - 95% LTV

- 99% LTV CONVENTIONAL LOAN

- PROGRESSIVE REPAYMENT MORTGAGE

- CONTRUCTION LOANS

- INVESTMENT PROPERTY LOANS - 85% LTV

- STATED MORTGAGE FOR PRIMARY -SECOND HOMES

- NO DOC FUNDING - 6 PROGRAMS

- FOREIGN NATIONAL LOANS

- ASSET BASED MORTGAGE LOAN

- FIX AND FLIP BRIDGE LOANS

- COMMERCIAL PROPERTY LOANS

- VOE MORTGAGE LOANS

- ITIN TAX ID LOAN

- USDA LOAN

- VA LOANS 100% LTV